Medical insurance is complicated.

Concierge medicine and Medicare present both opportunity and risk for entrepreneurial practices. At least half of Private Physicians Alliance practices do not bill Medicare or insurance, but for PPA members who choose to work with Medicare, understanding complex regulations is essential.

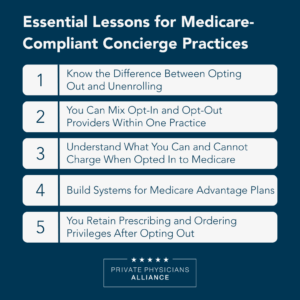

Private Physicians Alliance members have successfully built thriving practices with various approaches to Medicare participation. Here are five lessons from physicians who’ve chosen to work within the Medicare system.

Disclaimer: This blog post provides educational insights from physician experiences and is not intended to replace legal guidance from qualified healthcare attorneys.

How Does Concierge Medicine Work With Medicare?

For practices that accept Medicare, concierge medicine and Medicare work together in several ways, depending on your practice structure and participation status.

When you opt out of Medicare, you enter private contracts with Medicare patients and collect membership fees directly rather than billing Medicare. Patients pay out-of-pocket for your services while using Medicare benefits for hospitalizations, specialists, and other covered services outside your practice. You retain the ability to prescribe Medicare Part D medications and order Medicare-covered diagnostics.

When you opt in to Medicare, you can charge membership fees but must follow stricter compliance requirements. Your membership fee must cover services distinct from Medicare-covered services. You cannot treat Medicare patients differently from other patients or exclude them from your practice.

The hybrid option involves having some providers opt out while others opt in. This flexibility works well for practices with multiple providers.

The key is matching your Medicare strategy to your practice vision while maintaining rigorous compliance.

Lesson 1: Know the Difference Between Opting Out and Unenrolling

The biggest operational mistake practices make is confusing two very different Medicare relationships: opting out versus unenrolling.

Many physicians assume that opting out and unenrolling achieve the same goal. This confusion can permanently limit your practice’s future options.

Opting out allows you to enter private contracts with Medicare patients and collect fees directly. The process involves three steps: confirm eligibility, submit an opt-out affidavit, and enter private contracts with each Medicare patient. This status renews every two years and can be terminated within the first 90 days.

Unenrolling completely withdraws you from the Medicare program, making it difficult or impossible to adjust future participation.

Here’s the critical distinction: Unenrolled physicians can’t order tests, labs, and prescriptions through Medicare. Opted-out physicians retain these privileges.

For practices operating with Medicare participation, maintaining the ability to order covered diagnostics while collecting membership fees addresses many operational challenges.

Lesson 2: You Can Mix Opt-In and Opt-Out Providers Within One Practice

If your practice has opted out of Medicare, do all your physicians and nurse practitioners need to opt out?

The answer might surprise you: No.

Providers who remain opted in can operate autonomously within your opted-out practice to treat Medicare patients. One PPA member’s opted-out Florida practice hired a physician who remained opted in to continue moonlighting at the local hospital. The practice worked with their attorney to confirm complete compliance despite mixed provider statuses.

When managing mixed Medicare statuses:

- Differentiate between opted-out and opted-in providers in your billing systems.

- Review all public-facing content for accuracy.

- Consult healthcare attorneys specializing in Medicare compliance.

Remember that practices operate successfully with various approaches: some with all providers opted in, some with mixed statuses, and others with all providers opted out.

Lesson 3: Understand What You Can and Cannot Charge When Opted In to Medicare

When opted in to Medicare and charging membership fees, all outward-facing communication requires careful scrutiny for compliance.

Medicare doesn’t allow practices to exclude Medicare patients or treat them differently. You can’t offer Medicare patients different access levels or preferential treatment.

The key distinction: If Medicare covers a service, you can’t charge an additional cash fee for it.

To operate a membership practice while opted in:

Structure pricing carefully. Some practices screen potential patients to confirm they understand and accept the membership fee model. Referral-based acceptance often works well.

Define membership benefits clearly. Your agreement must specify which services the fee covers, distinct from Medicare-covered services. Frame fees around access, care coordination, and wellness planning.

Maintain transparency. Medicare patients must understand what they’re paying for versus what Medicare covers. This clarity protects your practice and your patients.

Every element of your practice must align with Medicare compliance requirements.

Lesson 4: Build Systems for Medicare Advantage Plans

Medicare Advantage (MA) plans add complexity to an already intricate system. With hundreds of plans, each with different coverage rules and networks, the diversity can overwhelm practices.

Successful PPA members have developed efficient systems for managing this complexity.

The basic strategy: Contact each MA plan directly and ask, “Are we in-network for this plan?”

Consider these workflow efficiencies:

- Designate a team member as the MA specialist who builds relationships with common local plans.

- Maintain a simple database tracking which MA plans you’re in-network with, updating quarterly.

- Be transparent with prospective patients about your verification process and potential out-of-pocket costs.

Creating a systematic approach makes what initially seems overwhelming manageable.

Lesson 5: You Retain Prescribing and Ordering Privileges After Opting Out

Many physicians are surprised to learn they retain important privileges within Medicare after opting out.

The Affordable Care Act specifies that prescribing medications covered under Medicare Part D is limited to participating, non-participating, and opted-out physicians. If you’ve opted out, you can still prescribe Part D medications and order Medicare-covered tests and labs.

The only providers unable to order prescriptions and tests are those on the Preclusion List (currently revoked from Medicare or convicted of a felony within the last 10 years).

This retained privilege matters for practices that have chosen the opt-out route. You can operate your membership-based model with private contracts while ensuring Medicare patients access covered prescriptions and diagnostics.

For many PPA members who work with Medicare, this represents a workable practice model.

Working Successfully Within Your Chosen Model

For practices working with Medicare, understanding these regulatory requirements helps you operate with confidence.

Know the distinction between opting out and unenrolling. Understand what you can charge. Develop systems for complexity.

When you face compliance questions about provider statuses, membership structures, or MA plan challenges, other PPA members who’ve chosen this path have worked through these exact issues.

Want to connect with physicians experienced in Medicare-compliant concierge practices? Private Physicians Alliance members access exclusive resources and peer support, regardless of whether you work with Medicare or operate independently. Learn more about membership and join a network of entrepreneurial physicians building sustainable practices.